Insight

DORA Compliance Checklist

This checklist provides a hands-on guide for Compliance, Risk, and IT teams in financial entities navigating the reporting requirements of the Digital Operational Resilience Act (DORA).

Read moreThe new Investment Firms Directive (IFD) and Investment Firms Regulation (IFR) regime creates, for the first time, a dedicated regulatory reporting framework for investment firms. Investment firms now have less than six months to prepare for implementation of the IFD/IFR, both of which apply in EU member states from June 26, 2021. For non-EU member states, such as the United Kingdom, the timeline for the introduction of UK’s Investment Firms Prudential Regime (IFPR) is different. HM Treasury, the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) decided to target an implementation date of January 1, 2022 for this regime.

Until now, IFD/IFR investment firms have fallen under the Capital Requirements Regulation (CRR) rules which were designed for traditional credit institutions. The new framework is closely aligned to the business model of an investment firm and is designed to address the specific risks posed by this sector.

New Minimum Capital Requirements:

This is the higher of the firm’s permanent minimum capital requirement under the IFR, its Fixed Overhead Requirement and its K-factor requirement (where applicable)

Activity based K-factor Approach for Own Funds Requirements:

K-Factors are a quantitative measurement of the risks posed by a firm to its clients, the markets in which it operates and to itself. There are three K-factor groupings: Risk to Client (RtC), Risk to Market (RtM) and Risk to Firm (RtF). Firms must calculate capital requirements against these categories according to the methodology prescribed in the IFR.

New Rules on Concentration Risk:

The IFR sets thresholds with respect to exposures in the trading book of the firm to a client, or group of connected clients. Where these thresholds are breached, firms must also hold additional capital and notify their Competent Authority. Concentration risk is embedded in the newly established K-factor model. As with the existing large exposure framework in CRR, processes to monitor the compliance with the new framework need to be established by the firm.

Liquidity Requirements for Investment Firms:

Firms must hold liquid assets equal to or greater than one third of their fixed overhead requirement. The definition of liquid assets is expanded compared with that in the CRR, with no limit as to their composition.

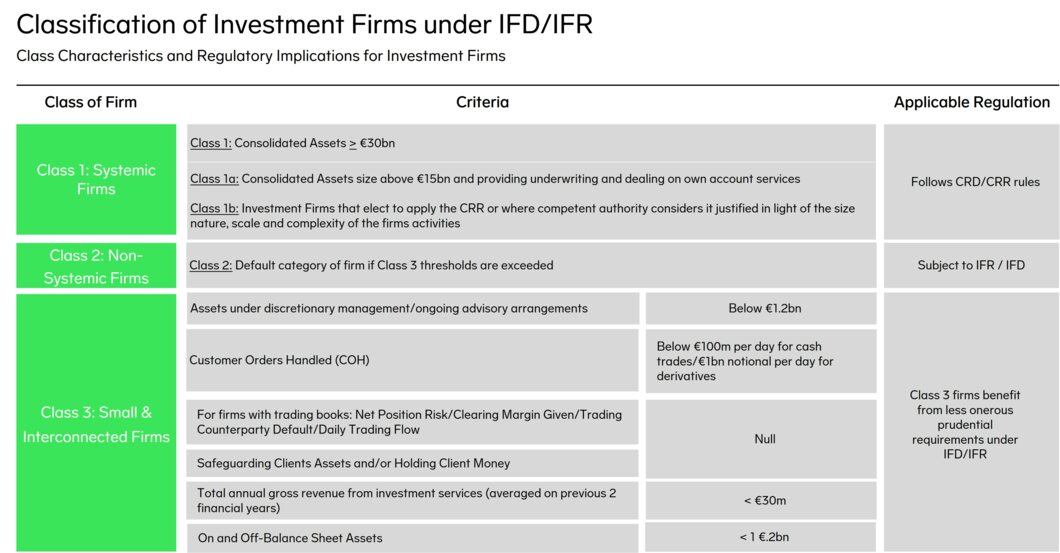

The new framework also introduces a new categorization system for investment firms based on their size, scope of business and the level of systemic risk posed.

Firms are expected to carry out their own analysis to determine which IFR investment firm class applies. In making this assessment, it is worth noting a recent view expressed by the Gerry Cross, Interim Director of Policy & Risk and Asset Management and Investment Bank at the Central Bank of Ireland (CBI). He stated that if a firm’s business plans are such that they are likely to fall under the CRR regime by meeting the €15bn threshold in the near future, then “it may make regulatory sense to move such firms across to the CRR regime at an earlier date to allow for effective and efficient supervision“.

Recent publications by the European Banking Authority (EBA) and CBI have provided additional insights into the IFD/IFR requirements.

In December 2020, EBA published a final report on its draft Regulatory Technical Standards (RTS) on the prudential treatment of investment firms. Addressing industry feedback on its June 2020 public consultation, EBA has provided clarifications around definitions and treatments. This included, for example, the definition of a financial entity in the context of IFD/IFR and the scope of a number of K-factor requirements, in particular assets under management (AUM).

On January 14, 2021, the CBI issued a Consultation Paper, CP135 Consultation on Competent Authority Discretions in the Investment Firms Directive and the Investment Firms Regulation. In this document, a number of discretions are addressed:

The CBI has signaled its intention to apply these discretions on a case-by-case basis. The onus is on the firm to apply for a discretion where it believes that it is relevant. The CBI has also indicated that in relation to the discretions, it will

This consultation is open until March 26, 2021 and the CBI intends to publish an ‘Implementation of NCA Discretions in IFD/IFR’ Regulatory Notice, where it will set out its approach to the exercise of these discretions, by the end June 2021.

The clock is ticking on the implementation of the new regime across the investment firm sector. In EU member states, IFD/IFR becomes effective from June 26, 2021 with a first reporting date of September 30, 2021. The imminence of this timeline was echoed by Gerry Cross of the CBI in his recent speech, where he stressed that “we expect that firms’ preparation for the IFR/IFD has been discussed at board level and that firms have stood up their implementation projects”.

The introduction of IFD/IFR will have significant impacts for Investment Firms. Firms need to take a holistic approach to the new requirements, which will include:

Insight

This checklist provides a hands-on guide for Compliance, Risk, and IT teams in financial entities navigating the reporting requirements of the Digital Operational Resilience Act (DORA).

Read moreInsight

The European Central Bank (ECB) has announced a revised timeline for the implementation of the Integrated Reporting Framework (IReF), with full adoption now scheduled for 2029.

Read moreInsight

Discover the different deployment options for financial institutions in their regulatory reporting needs, pros and cons for the cloud options, and the shift from traditional in-house systems to managed services for greater flexibility, cost efficiency, and access to specialized expertise.

Read more