Panel discussion: Harmonized and granular European reporting

There have been two significant trends in the regulatory reporting space for a decade or so. One is a trend towards more harmonization, with the EBA leading the efforts across Europe. Another trend is towards more granular reporting such as Analytical Credit Datasets (AnaCredit) and Statistics on Holdings of Securities Reporting (SHS).

These trends will continue for some time, but how far will they go? How fast will they become reality? What will the future look like? What are the upsides and what are the risks?

Hear supervisors and banks discuss the trends and implications in regulatory reporting:

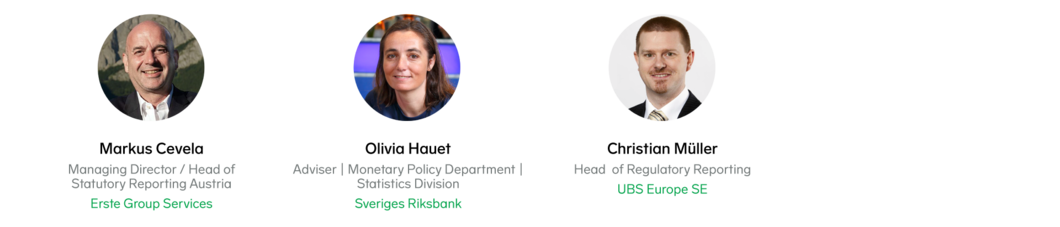

Speakers

One of the keys for the success in Austria was this common collaboration and permanent exchange. Not only does the national bank require things and banks need to do it, but really to exchange on the process and data models.

Markus Cevela, Managing Director/Head of Statutory Reporting Austria, Erste Group Services

IReF really follows a very strong call from the banking industry, with the motto, "define once; report once". So it's really important to make the IReF successful because that may condition further integration.

Olivia Hauet, Adviser/Monetary Policy Department/Statistics Division, Sveriges Riksbank

It will be a fundamental shift from a template-based reporting down to a very granular data model […] where the provided information will be significantly more granular and more transparent also to the regulator.

Christian Mueller, Head of Regulatory Reporting, UBS Europe SE

Contenu

Our experts present the current readiness of EU-banks for ESG reporting, key data challenges they are facing and the essential areas that banks need to focus on and analyze in order to have a complete and accurate picture of the current state of sustainability.

LireContenu

Our experts discuss key findings from the respective proof of concepts launched by the innovation hubs of the Bank of England and BaFin in partnership with Commerzbank, and explore new solutions for more data-driven regulatory reporting infrastructures.

LireContenu

Find out how to take the practical steps to overcome the challenges and obstacles to make ESG and climate risk an integral part of banks' reporting framework.

Lire